When House Prices Drop

Putting more money towards your mortgage in advance gives you more protection from big losses when housing prices drop.

Remember the Great Recession of 2008 and the housing crash? Me neither. For many people, especially if you weren’t a homeowner at the time, the housing turmoil of 2008 is just a foggy memory. And, with house prices having risen dramatically since, it’s hard to throw up a caution sign, even though we know that the Michigan economy is cooling.

I’m going to do it anyway.

If you remember, during the housing crash, many homeowners were foreclosed on and lost their homes. When average housing prices hit rock bottom in 2012, nearly 30 percent of houses nationwide were underwater.

Underwater—this term was thrown around a lot during that time. No, it does not mean your house is flooded or some type of hurricane has wiped it out. Rather, it means that you owe more money to your mortgage lender than your house is worth.

For homeowners during the Great Recession, the collapse of housing prices obliterated their equity. Equity, for our purposes, is your degree of ownership in your house. Wiping out their equity pushed the home’s value so low it was like none of them had even paid a down payment—in fact, they owed their bank even more.

While I am not saying we need to run for the hills and stop buying houses, with house prices at a peak and the Michigan economy cooling, I’m here to remind homeowners of this one principle:

When housing prices fall, those with little ownership (equity) in their homes get roasted.

By remembering this fact, we can now access our current levels of ownership in our house. How far along are you in the equity-building process? You can do this by looking at your mortgage: Access how much debt you have remaining verses how much you still have to pay off. Is it a lot? Or, are you one of those people who are further along in your mortgage, perhaps having 50 percent paid off or more?

Now, if you don’t plan on moving from your house for years (or even moving at all), you might as well be the Rip Van Winkle of homeownership and sleep for centuries. You’ll be able to sit in your house for ten or twenty years, riding out any downturn in the housing market. Hence, the rise and fall of house prices may not be as important to you in the short term.

For the vast majority of us who may be considering moving at some point, perhaps those of us who plan to get bigger houses for raising a family or moving to a different county to take a better job, you’ll want to listen closely to this concept of equity that I’m going to lay down.

Understanding that when housing prices fall, those with the least amount of ownership in their home get burned the most will allow you to take action now (or not take actions you would have taken) with this principle in mind. Let’s dig into this subject deeper.

The Concept Of Equity Building

Now I don’t want to take away too much from the concept of equity building, which I talked about in my very first blog article. As you make interest and principle payments on your mortgage; that money, over time, eventually grows to the point where you have a large ownership stake or even pay off your house entirely. For many Americans, the money they put into their house is the vast bulk of their savings.

Real estate gurus will take this equity building concept one step further when it comes to real estate investment. They argue that you should use “other people’s money” to make your own money. They’ll tell real estate investors to take out large mortgages on a property and then encourage them to take mortgages out on future properties in addition to the one they already have. They put stories out there about how you need to acquire one, two, or three rental properties within a span of only a few years.

While I agree with the equity building concept in principle, these gurus never talk about what you should do to protect yourself when housing prices fall. Instead, they espouse these strategies even after the economic winds have changed, making such equity building strategies more difficult and less viable.

Ok, so that’s the idea sold to real estate investors. Let’s set that aside.

Where the guy or gal who’s looking to buy just a single-family home to live in gets sold downriver is the idea that buying a home is always a smart decision. The government, the banks, and the mortgage industries are very good about selling this idea.

It’s not so much that they’re selling it to trick us or mislead us. It’s just that they make so much dang money from selling people houses that they’d rather you focus on the good things and forget about the bad.

The U.S. housing market is a worth a massive $27 trillion dollars, worth more than the United States produces in goods and services for an entire year. It’s vital to the nation’s interest that the U.S. housing market stays vibrant and prosperous. They need you to buy houses, both in good times and in bad.

So, you can imagine with housing being so important to the economy, it’d be hard for these institutions to tell people to, “occasionally be mildly cautious about buying a house.”

How Buying A House With Little Or No Money Down Will Crush You When Prices Fall

I’m here to tell you that in a softening Michigan economy, now is the time to use a bit of caution with your housing search, especially if you plan to purchase with a down payment of 20 percent or less.

The reason for caution is because the people who buy a house with less will see that initial down payment get crushed the hardest when housing prices fall. That initial money you put into the house will get creamed even if house prices dip just a little.

No one ever talks about it, but when you take out a mortgage, all you’re basically doing is tapping debt (in many cases, a lot it) to buy your house. People call it, “taking out a mortgage,” which it is, sure, but it sort of sugar-coats the reality of the situation.

Even more of a sugary marketing ploy is that, afterwards, you’re a, “homeowner,” and you run around saying that you, “own a home,” which is not quite correct by financial terms. Rather, you own a part of your home and are granted control over the property, which allows you to live in it, providing you pay your mortgage. So if people really wanted to be accurate, they would say, “I control a home!” Yet this of course sounds much less exciting.

So right now, think of your mortgage as “debt” and your down payment and whatever you’ve contributed to paying off your mortgage as “equity.” Remember, your equity is your degree of ownership in your house.

This debt and equity cocktail that your mortgage essentially is gets really interesting when housing prices fall. The reason is that when prices fall, the only component that is affected is your equity. Your equity will absorb the entire blow. And, the smaller your equity, the harder that blow is going to fall on each dollar.

So going back to the cocktail analogy, imagine that it’s a martini. Your equity is the vermouth and your debt is the gin. The more vermouth you add, the sweeter and more mellow the gin becomes. Similarly, the more equity you have in your house, the softer falling prices will hit and the more palatable your situation will be.

You can see this in the examples below. I’ve laid out three scenarios from the worst case to the best case. In all cases, the house under consideration is bought for $200,000. You can access my full data worksheet here:

In the first case, the “worst case,” the person has 20% equity (ownership) in their home. Remember, 20% is typical with conventional mortgages. Lots of people go with 20% down because either: 1) Its the minimum amount required by their mortgage lender or 2) It gets them out of paying private mortgage insurance—or both. That amount is $20,000.

Now, to buy that $200,000 home, the person takes out a mortgage. So, we chalk up $180,000 in the debt column. Between the $20,000 in equity and $180,000 in debt, the person has enough to buy the house—the cocktail has been made:

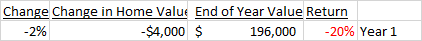

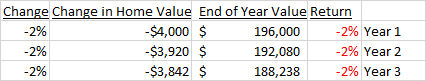

Let’s assume that the moment the person buys the house, housing prices start to fall. In fact, they fall 2%, which at first blush doesn’t sound too bad. After Year 1, the change in home value has dropped by $4,000. Allright, so now their $200,000 house is worth $196,000:

Remember, we have very little vermouth in this debt/equity cocktail. There’s a lot of bitter gin in this drink. And, remember the rule that a drop in housing prices will hit your equity right in the face.

All of that $4,000 loss has to come out of your equity. Since you only had $20,000 to start with, now you only have $16,000. You’ve lost -20% of what you started with!

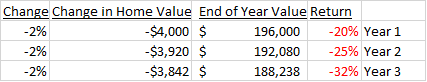

In Years 2 and 3, house prices continue to drop by 2% each year. In Year 2, you lose $3,920. In Year 3, you lose $3,842. And, your equity continues to get hammered -25% and -32% respectively.

What was $20,000 in equity when you bought your house has now eroded to about $12,000. You’ve lost $8,000 in only a few years. It’s like you’re drinking straight gin, and it’s disgusting.

Meanwhile, the bank doesn’t give a rip. Your debt hasn’t dropped a dime, still sitting at a hefty $180,000. You still owe them your 4% interest each year. And, they don’t have to worry about the falling house prices like you. In fact, if you lose your job and start missing your interest payments, the bank is strongly incentivized to not work with you and kick you out of the house as quickly as possible. They know that prices are falling and will want you out in order to sell the house to a new person before prices drop even lower.

This scenario was something that was reality in the housing crash that accompanied the Great Recession. While that situation was certainly on the extreme end, let’s remember: I’ve only done an example with a drop in home prices of 2%, which is pretty modest. Imagine how bad a bigger drop would be in our example above, all other factors being equal? I chose a modest percentage to illustrate a point—that even small drops in home prices can have big effects when you have little equity in your home.

The Advantages Of Having Made A Higher Down Payment When Prices Fall

Now let’s consider what happens if we boosted our down payment to 50%. Now I know what you’re thinking: Who has the type of money to put down a 50% down payment?! Well, let’s say maybe you put the 20% down initially and then aggressively make your interest payments to build toward that 50%. Either way, increasing your equity will protect you from large percentage losses when prices fall.

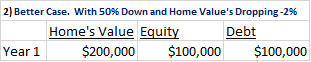

Next, we’ll look at an example were we add some sweet vermouth to the debt/equity cocktail that is our mortgage. Sticking with the same number as in our above example, let’s again assume our house is worth $200,000. We made as big a down payment as possible and have spent a couple years making some good payments on our mortgage. In fact, we’ve done so well that 50% of our mortgage is equity and 50% of our mortgage is debt.

As a result, we’ve got $100,000 of debt but also have $100,000 of equity. House prices start to drop at the same 2% rate we used in the example above. The equity still takes the full brunt of the drop but, remember, our equity in this example is five times larger than it was in the worst case scenario.

We still lose $4,000 after the first year, however, we have $100,000 in equity to absorb this blow. Whereas in the worst case we were getting creamed, our equity takes it much better. Like a big cave troll shrugging off the punches of a hobbit, we do much better. Our $100,000 in equity drops to $96,000, yet we’ve only lost 4% of our equity, compared to 20% of our equity in the previous scenario.

Yes, you’re still losing money in the better case scenario, but I’d rather lose 4% of my equity than 20% any day.

Having compared a worse case scenario to a better case scenario, we can now see that having more equity in our house cushions the blow of a drop in prices. It makes that ginny martini much more appealing. And, you’ll rest easier knowing that the money you’ve put into your home isn’t plunging by double-digits this year.

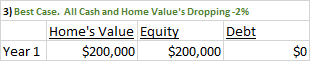

For s’s and g’s, I’ve included a final, best case scenario. Here, we still have the same $200,000 house, yet the person has bought it for all cash.

Yes, all cash.

They have a $200,000 home and 100% of the equity ($200,000). The house is still subject to the 2% drop in house prices each year as prices cool. Likewise, the house still loses $4,000 in the first year. Yet, it’s spread over the entire value of the house. As such, this person only loses -2% each year.

Even Just Putting A Bit More Money Into Your House Can Protect You From Big Consequences

Now, I labeled this the best case scenario because the loss in equity is the smallest (only -2% versus a -20%+ loss in our worse case scenario). However, comparing this best case scenario to our better case scenario (a loss of -4%), the better case scenario does pretty darn good.

Having just half the amount of equity as the best case scenario, we’ve managed to get our loss to about -4%. While still bigger than the -2% loss in our best case scenario, it’s a far cry from the -20%+ train we get hit by in our worst case scenario. Therefore, remember that we don’t need to have a completely paid off house to go a long way in protecting ourselves from loss when prices cool. We can still have a bit of gin in our martini but we make sure it’s balanced with a generous amount of sweet vermouth.

So while it’s obviously nice to have your house completely paid off, you minimize your equity losses quite nicely by having a somewhat larger chunk of money at play in your mortgage cocktail.

You Can Still Buy Houses Right Now. Just Consider A Couple Factors.

As we move out from last summer’s white-hot housing prices and recognize that Michigan’s economy is cooling, I need to state that it’s still ok to buy houses. However, let’s be extra mindful of the principle that as housing prices cool, those with little ownership (equity) in their house get burned the most.

This should prompt us to seriously consider a few factors that we may not have been paying close attention: First, weigh the pros and cons of how much money you plan to put down for your down payment. If you already own a home, consider cutting back on some expenses and contributing more to your mortgage. Remind yourself that whereas your neighbors may have been adding to their wealth the past eight years by owning their home, you are less likely to have the same luck for the next eight.

Second, consider in detail how long you intend to live in the house. If you’ll be upgrading in the next couple years, or moving for that new job–consider what you’ll do if the house you purchased this year is worth less. It doesn’t mean that you won’t still make these moves, but it does mean you’ll make better personal choices today about what house you buy and how you’ll finance it. You’ll also set yourself up better to make these life moves in the near future.