But Where Are My Mortgage Payments Actually Going?

While it may seem like your mortgage payment goes into an electronic abyss, don’t worry. You’re making progress towards paying off your mortgage.

All too often, in my conversations with homeowners in the Metro Detroit Area where I practice real estate, I discover that people don’t have enough knowledge on where their mortgage payment actually goes. Every month, they diligently send out their mortgage payment, the largest bill by far that most people will pay each month, into an electronic abyss…

All too often, in my conversations with homeowners in the Metro Detroit Area where I practice real estate, I discover that people don’t have enough knowledge on where their mortgage payment actually goes. Every month, they diligently send out their mortgage payment, the largest bill by far that most people pay each month, into an electronic abyss. And, despite their consistent monthly payments, when they login to their lender’s website to check their mortgage balance, they’re often frustrated at how little progress is made: “My balance never goes down!” “All of my money is going to interest payments!” is the kind of shock I often hear expressed. While I hear such distress from homeowners of all ages and all stages of ownership, I hear it most from my millennial friends who are just starting down the homeownership path. I always talk with my clients about the realities of mortgage payments when looking at real estate, so I feel it’s necessary to explain a few basics about mortgage payments to you here reading. If you’re a frustrated millennial homeowner, new homeowner, or homeowner period, I’d like to arm you with some knowledge about how mortgage payments break down to give you some motivation on your homeownership journey.

While the perplexion on mortgage payments is nearly universally-held and we’re all in good company here, it’s necessary that homeowners understand the basic principles of what’s called in “the real estate business” mortgage amortization—a word too big in my opinion for what is really a simple concept; your mortgage balance will go down as you make your mortgage payments. This seems easy but what has everyone pulling their hair out is that when you’re a new homeowner only a tiny smidge of your payment goes towards paying down your remaining mortgage balance or “principal.” So, when you first move in, it looks like your balance is never going to go down. Your principal is the amount of money you borrowed from your mortgage lender when you bought your home.

So where does the rest of your payment go if not to your principal? It goes to pay your accrued interest or the amount of money that is owed to your lender for giving you the money you used to purchase your home. On most traditional mortgages, it usually works that, while you’re out doing whatever it is you do during the month, interest is quietly being added to your principal. By the end of the year, this interest amount might total 4 percent, 4.5 percent, or more (or less). This figure is known as your annual percentage yield or what most people call their interest rate—this should sound familiar! So, if you’re new to the mortgage game, the monthly interest can seem huge and leaves people feeling they’re just throwing their hard-earned cash away. This effect is what I call the “interest rate blackhole.”

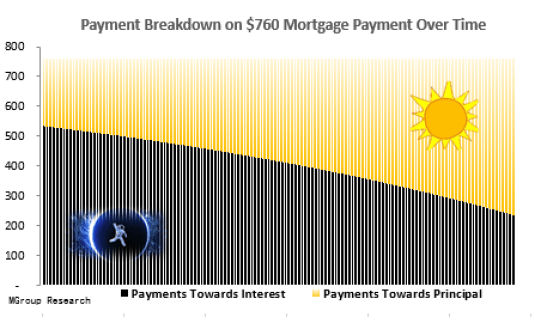

Luckily, a homeowner making consistent mortgage payments and building equity will climb out of the interest rate blackhole with growing effectiveness as an increasing amount of your dollars goes towards the principal. Additional payments on top of your normal monthly mortgage payment will only accelerate this process. In the picture below, you can see the powerful effect of the interest blackhole in the beginning of a mortgage payment. And, as your mortgage is paid down, principal begins to build as we move towards what I like to call, “daylight.”

As you make your mortgage payments, more and more of your money will go towards your mortgage principal (see how the sunlight starts to grow toward the end?). As your outstanding mortgage balance begins to be reduced, that accrued interest that had been building every month and was causing you great annoyance will start to look smaller and smaller. Eventually, you will hit a critical point where the amount of money that you’re paying towards interest is now less than the amount of money that you’re paying towards principal. You can think of it this way: I always explain to my clients when they are considering buying a home that paying off a mortgage is like eating a Klondike Bar, you have to take off the aluminum wrapper and bite through the hard, chocolate shell to get to the soft, vanilla ice cream inside—which I think we can all agree is the best part.

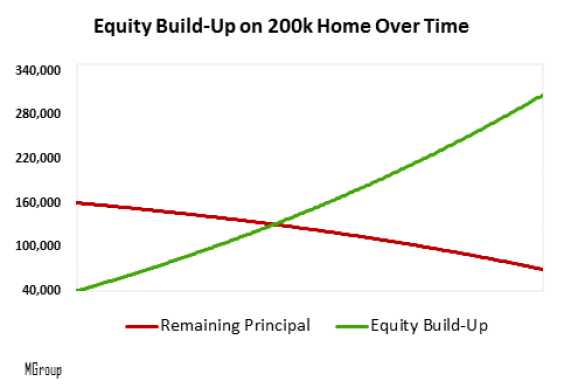

As your payments towards principal grow, it will make a nice upward curve (shown in green), while the amount going towards interest (shown in red) continues to fall. Check out what this looks like on a $200,000 home with a traditional mortgage and $40,000 down:

See how that green equity line takes off? This phenomenon is called equity-building, or the increasing ownership stake you start to have in your home over time. That’s you building equity in your house by persistently paying down your mortgage! Eventually, this diligence will lead you to paying off your house and owning your home “free-and-clear” without any type of mortgage payment. Yes that’s right, no mortgage payment whatsoever! What began as a hard, uphill slog is now a downhill sprint. Old exasperation at paying the mortgage is replaced by the sense of accomplishment of a job well done and a future that is becoming increasingly secure and prosperous.

“Paying off a mortgage is like eating a Klondike Bar, you have to take off the aluminum wrapper and bite through the hard, chocolate shell to get to the soft, vanilla ice cream inside.”

To keep our motivation up and ultimately be successful in homeowners, it’s important that we understand that the frustration one can feel as a new homeowner towards their mortgage payment is a temporary but emotional consequence of people paying into the interest rate blackhole every month. Yet, with our new understanding of the break down of our mortgage payment, we can stay positive and power through to a new level of satisfaction in home ownership.