Low And No Down Payment Mortgage Options

They’re out there. However, you have to meet the requirements.

“Dang, if I could only get my own house,” is a common feeling held by many people. For some, renting a place can get old. Perhaps it’s due to a nosey or downright scummy landlord who’s always coming around your property without notice. Instead, maybe the problem is the loud and inconsiderate roommate you got stuck with after rolling the dice on Craigslist.

Look, I get it. Eventually, no matter how patient you are, everyone needs their own space—and often this means getting your own…well…place.

I was feeling this recently for my client, Tim, whose roommate was starting to drive him nuts. Now, his roommate had always been a bit irritating. Most of the crap in the apartment was his: the furniture, TV, and pots and pans. There was even a broken treadmill in the living room. On the other hand, Tim never had a lot of stuff, so it usually didn’t bother him.

However, the situation got worse. About six months ago, his roommate lost his job as a personal trainer and had to downgrade to a lessor paying job working the front desk at Gold’s Gym. Hard times happen: Tim understood this from his own personal experience. Being the considerate person he is, Tim offered to pay the difference in rent for the next month.

What Tim couldn’t understand was why his roommate, despite having a reduced income, continued to insist on keeping the heat dialed up well past 75 degrees, even in the middle of winter, and when both of them were at work. So, the heating bills had always been an astronomical hundred dollars a month.

As a solution, Tim recommended that they turn the heat down to save money. Unfortunately, his roommate wasn’t interested and continued to jack it up. Nor, at Tim’s recommendation, was he interested in selling some of the crap he had all over the apartment to raise some money for rent—including the broken treadmill.

This was the final straw for Tim. He knew that he wanted to buy his own place but had been under the impression that he would never be able to get a mortgage. This apprehension was primarily due to his current job. He worked as a day manager at a retail store making $15 dollars an hour, which he felt was not enough. Adding to Tim’s woes was that he didn’t really have any money saved toward a down payment.

Still, he kept dreaming about having his own place. He was sick of coming back every day to his blast furnace of an apartment, always seeing his roommate sitting on the couch looking at him to pay the bills.

People like Tim tend to judge themselves before they try to get a mortgage. From what I’ve observed, this can dissuade people from checking to see if they can get pre-approval. So please:

Don’t count yourself out!

While Tim isn’t killing it with his income, let’s face it, he’s not doing too bad either for a single guy in Michigan. With that in mind, let’s consider what mortgage lenders actually look for when they’re considering a candidate.

Despite what Tim might think, mortgage lenders look at things like how long you’ve been making your income, what your employment status is, how much debt you have, and how much of a mortgage you’re looking to get. So, Tim’s income may be just fine (on the other hand, I’ve also seen people wrongfully assume someone will just hand them a mortgage when they’re woefully unqualified—we’ll save that for another time). Tim just needs to get pre-qualified by a mortgage lender and come up with enough money for the down payment.

Fortunately for Tim, right now there’s several low or even no down payment mortgage options out there for folks like him. These mortgage options are being offered through Michigan mortgage lenders like Fifth Third and Flagstar and made possible through government institutions like the Federal Housing Administration (FHA). Look sharp though, there’s some requirements and qualifying factors you’ll need to meet in order to be eligible. However, if you’re like Tim who meets the qualifying factors—steady income, not too much debt—these mortgage options might be your ticket to a new home.

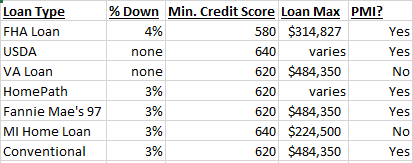

I’ve captured the numbers behind the various mortgage options in the handy table below. Mind you, these numbers and options do change with time but do give you a general sense of what’s out there. This way, you can see them all up front prior to diving into the rest of the article:

Don’t Count Yourself Out Of A Mortgage

What Tim didn’t realize was that he was actually a fine candidate for a mortgage. In fact, $15 an hour is the equivalent of about $31,200 a year. Plus, Tim mowed lawns during the summer for an additional $3,000 a year, bringing his total income before taxes to $34,200, which can go a surprisingly long way in metro Detroit.

Tim was also ignoring some his strengths that a mortgage lender would instantly recognize. For one, he had no debt. So while he’s not pulling a six-figure income, he doesn’t have obligations like credit cards, student loans, or car loans sucking up his existing income.

Tim’s lack of debt in relation to his income is really going to help when the mortgage company considers his back-end debt to income ratio. According to the Consumer Financial Protection Bureau (CFPB), a government agency responsible for protecting consumers in the mortgage industry, a person’s back-end debt to income ratio should not be greater 43 percent. Put another way, a person’s debt should not be more than 43 cents to every dollar of monthly income they bring in.

Tim’s back-end debt to income ratio is a factor his mortgage lender will look at when considering whether or not to give a mortgage. It measures the total cost of everything he owes on a monthly basis in relation to his total monthly income.

Another advantage Tim has is that he’s not looking for a mansion. He’s a single guy just looking for a nice, simple, one story house in the metro Detroit area—something about $100,000. Tim is realistic about both how much house he needs and how much he can afford. This type of house can still be had in decent Michigan neighborhoods and with house prices cooling, the odds are increasingly in Tim’s favor for finding a nice place.

However, Tim doesn’t have a lot saved toward a down payment. But that’s ok. Contrary to popular belief, you don’t need to put 20 percent down on a mortgage (although there are benefits to putting down a bigger down payment that you should consider). Rather, there are people out there putting 3 percent or even no money down on houses in metro Detroit right now. What’s making these low and even no down payment options possible is a bevy of robust mortgage programs offered through Michigan mortgage lenders as well as state and federal institutions which I’ll outline below.

Michigan State Housing Development Authority (MSHDA)

It’s pretty obvious that the State of Michigan’s MSHDA program takes housing seriously. It’s stated purpose is literally, “to get people into houses.” The Michigan Home Loan program is available to first-time home buyers state-wide as well as certain repeat home buyers in targeted areas. Check here for a list of targeted areas.

The Michigan Home Loan program provides down payment money up to $7,500. Buyers start by finding a lender through MSHDA’s Loan Officer Locator, which you can find here.

To be eligible, you have to be within the program’s income limits. These income limits will flex depending on how many people are in your family and where the property is located. They also cap the sales price limit of eligible properties to $224,500 statewide, yet this still covers a lot. Lastly, a minimum credit score of 640 is required.

Conventional Loans

Conventional loans are generally stricter in their borrowing requirements. The typical down payment tends to be at least 5 percent. Yet, you can get a loan with as little as 3 to 3.5% down. Conventional lenders will want to see a debt to income ratio of 36 percent, more stringent than the FHA, USDA, and VA loans.

To qualify for 3 or 3.5% down, you’ll need a good credit score. In Tim’s case, since he’s been paying his bills for quite a while and has a long credit history, he has a good credit score. Buyers who are unable to get a conventional loan due to a poor credit score can look at FHA and USDA loans.

Federal Housing Administration (FHA) Loans

The Federal Housing Administration (FHA), commonly known as the FHA, has been making it cheaper for people to get loans since 1934. They basically agree to back your mortgage lender in the event you stop paying. This agreement can make you more likely to get a loan.

You’ll still need to put at least 3.5% down for your down payment. For this low down payment option, you’ll need a minimum credit score of 580 (you can get away with a credit score minimum of 500 for an FHA loan but need to put up a 10% down payment). You’ll be required to carry Private Mortgage Insurance (PMI) which will be rolled into your loan (so you won’t have to pay anything up front) and it can be canceled once you build more equity in your house.

You’ll also need to also show that you have a minimum of three months of mortgage payments in savings to show you’ll be able to make your payments—at least in the short term.

Last, you’ll need to meet a back-end debt to income ratio requirement of 43 percent. All this means is that the FHA doesn’t want your mortgage payment, insurance, and taxes plus your other obligations (car loans, student loans, and credit cards, for example), to be worth more than 43 percent of your monthly income.

So, if you make $2,850 a month like Tim (annualized from his $34,200 salary), you can’t have your mortgage payment, insurance, taxes and things like student loans and car payments be more than $1,225.50 each month. And, in his case, he doesn’t have any payments! So for Tim, considering only his back-end debt to income ratio, he should be able to pay as much as $1,225.50 towards his mortgage, insurance, and property taxes every month. Mind you, this is just what his maximum back-end debt to income ratio will bear—there’s other factors that will be taken into account before the lender agrees on a mortgage to give him. Nevertheless, this is a good start.

United States Department of Agriculture (USDA) Loans

Depending on where Tim wants to live, he should also consider a loan from the USDA. No, he doesn’t need to be looking for a farm house to use it, USDA Loans also apply to certain suburban areas. USDA loans are issued through the USDA loan program, also known as the USDA Rural Development Guaranteed Housing Loan Program. You can check to see what areas are eligible here.

USDA loans require no down payment. That’s right, no down payment. So in Tim’s case, as he does not have a lot of cash for one, this could be very useful. Nor does it require cash reserves (savings that can be applied to mortgage payments). The loan has a monthly PMI requirement but the cost is lower than other loans out there at about .35%. Also, you can roll any repairs the place needs into the loan amount.

For a USDA loan, you need to intend to live in the house. You are required to pay an upfront fee for the USDA loan totaling 1% of the loan value. So, Tim will have to pay $1,000 for his $100,000 house. However, he doesn’t pay this up front. Rather, it can be rolled into the total value of his loan and paid over time. Your debt to income ratio cannot be greater than 41% of your income, slightly more strict than with the FDA loan. Again, this won’t be a problem for Tim. It is helpful if you have at least a 640 credit score or greater, although you can get a loan with less. Lastly, you need to have been earning a reliable income for at least 24 months or so.

In order to qualify, the house can’t be more than 15% greater than the median house price in the area. There is a limit to how much income you can make to qualify for a USDA loan. The typical maximum household income is $73,600 and up to $103,400 in a high cost area. In Tim’s case, he falls well below this limit.

Fannie Mae’s HomePath Loans

While the next one won’t really help Tim but it’s worth bringing up. Fannie Mae’s HomePath mortgage program is a good option if you have multiple family members. It works with Fannie Mae’s HomePath online program where you can purchase Fannie Mae properties that are going to be foreclosed. This program considers the incomes of everyone living in the house, increasing your chances of getting qualified, whether they be parents, children, boarders who rent from you—whoever!

Houses on the Housing and Urban Development (HUD) website through the HomePath program can be purchased with a 3% percent down payment. You’ll also get a 3% credit towards your closing costs after you attend the program’s mandatory home buyer education course. Any mortgage lender that is a Fannie Mae seller is able to offer HomePath loans.

The HomePath mortgage program applies to HomePath properties throughout Michigan. These are properties that have been turned over to Fannie Mae as a result of foreclosure. The property types include condominiums to single-family homes. You’ll need to take the HomePath Ready Buyer course to be eligible. Also, you need to have a 620 credit score or greater with borrowers above a 680 getting better pricing.

Fannie Mae’s Conventional Loan 97

Not to be confused with a conventional mortgage: This second loan option from Fannie Mae could apply to Tim if his parents were providing him money toward his down payment. Not to be left out, Fannie Mae and Freddie Mac came up with their version of a down payment loan just recently. The Conventional Loan 97 allows you to use gift money for the entire down payment as long as the money is given by someone related to you by blood, marriage, legal guardianship, etc.

The nice thing about the Conventional Loan 97 is that you can use it everywhere. The minimum down payment is 3%.

This loan only applies to single-unit dwellings under $484,350. The loan cannot be used for vacation houses or investment properties. Also, you have to use the Conventional Loan 97 with a 30-year fixed rate mortgage.

Veteran Affairs (VA) Loans

VA loans are offered through the Department of Veterans Affairs (VA) to members of the U.S. military, veterans, and surviving spouses. I won’t go into a ton of detail right now as I did a whole article on VA loans and how to get them that you can check out.

I will say, however, that for eligible veterans, they allow for zero down payment. And, they have no debt to income requirements: It’s not unheard of for someone to have a debt to income ratio as high as 70 percent. This is much higher than the 43 percent limit on the FHA loan or the 36 percent limit on conventional mortgages. Additionally, you don’t need to have great credit—even a bankruptcy is not an automatic disqualification.

Closing The Down Payment Gap

Tim’s biggest problem remains that he doesn’t have a lot of cash to put down towards a down payment. So, he’s going to need some help.

There are two banks out there right now, Flagstar and Fifth Third, that have thought of people like Tim. To cover his down payment gap, they offer down payment assistance programs which provides money for the down payment.

The catch is that the program only covers houses in qualifying areas across 18 Michigan counties. Check here to find the qualifying areas but they include homes in: Detroit, Flint, Inkster, Hamtramack, Hazel Park, Warren, and Livonia.

Flagstar will provide up to $3,500 toward down payment and closing costs. Qualifying buyers generally have an income between $35,000 and $62,000 a year. Sales prices in qualifying areas must be between $80,000 and $175,000. The amount they provide may be taxable by the IRS.

Fifth Third Bank in Michigan also has a similar down payment assistance program. It will provide money up to $3,600 of assistance on homes up to $130,000. To qualify, a buyer must be able to meet standards set by the Federal Financial Institutions Examination Council (FFIEC).

Last Ditch Options

If Tim is still having trouble mustering the funds needed for his down payment, there’s a few other options he could try. First, he could have a garage sale and sell off that old motorcycle in the garage he has sitting around.

I don’t think Tim we’ll have to do this though. He’s got good qualities that mortgage lenders look for: no debt, a long history of paying his bills, and the house he’s looking for is reasonably priced to his income level. Tim will be out of his doomsday roommate scenario and into a nice, single-story home in no time.